How 15-cent stickers can save Walmart over $125 million

In December of 2018, I had the opportunity to participate in a consulting engagement with Walmart Canada, in efforts to provide a recommendation regarding the following challenge.

How to deliver a great customer service experience, while maintaining a low-cost operating model

Beginning with site visits to stores and interviews conducted with store managers and members of Walmart Canada’s innovation team, I spent over 120 hours researching and developing a solution to decrease inefficiencies and increase effectiveness in a store’s inventory management strategy.

The recommendation revolved around integrating RFID tags at the item-level, installing roof-mounted RFID sensors, and integrating the RFID management system with point-of-sale (POS) and vendor-managed inventory (VMI) systems.

What is RFID

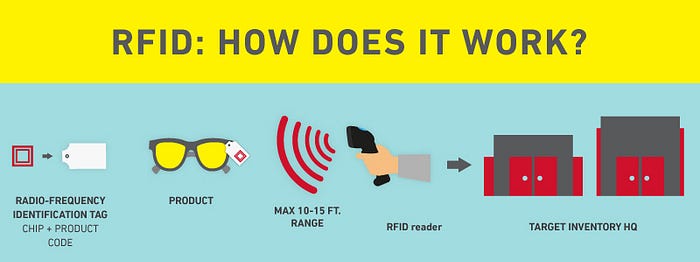

Radio frequency identification (RFID) is a technology that utilizes radio frequencies to transmit information without the need for internet connectivity, with options for operation with and without battery power.

Any RFID strategy has two components: tags and sensors.

RFID tags are small devices that contain an integrated circuit and antenna. When a signal of a preset frequency is intercepted, an RFID tag uses the energy from the signal to echo back a predefined set of information (for example, an alphanumeric key).

RFID sensors are the devices that emit this signal of the predecided frequency, in order to solicit the response of desired RFID tags.

Applications range a variety of industries; from corporate asset tracking to supply chain management.

Following is a summary of my recommendation provided to Walmart Canada.

Executive Summary

Opportunity

Walmart Canada does not track item counts or location in real-time, and experiences over $735mm in annual losses due to such inventory distortion, item misplacement, theft & fraud, and excess stock on hand.

Recommendation

Walmart Canada should mandate manufacturers to embed RFID tags at an item-level, and implement a store-wide network of RFID sensors to automatically track real-time location in store and counts of inventory on shelves.

Impact

Walmart Canada would experience 13% lower stock-on-hand, inventory accuracy improvement up to 97%, and 20% reduction in out-of-stock SKUs, among other improvements, translate to over ~ $125 mm in annual savings, through the implementation of this recommendation.

Opportunity: Inventory inaccuracies and distortion are the greatest cost threat to Walmart Canada

Sources of Costs: Inventory distortion and theft costs ~$735 mm in Canada

~ $372 mm in losses from item overstock and understock. This is calculated by applying average industry percent loss of revenue for this cause and scaled down using Walmart Canada revenue.

~ $217 mm in loss of sales from shoplifting and fraudulent product returns. This is calculated by applying annual loss as a percent of revenue from this cause for Walmart US and scaled down using Walmart Canada revenue.

~ $149 mm in loss of sales due to demanded items being out-of-stock. Calculated by applying annual loss as a percent of revenue from this cause for Walmart US and scaled down using Walmart Canada revenue.

Current inventory practices: Walmart keeps infrequent and inaccurate tracking of inventory today

Monthly Inventory Audits: Associates counting inventory and calculating shrink on a monthly basis are too infrequent to keep up with rapid changes in inventory.

Automatic Inventory System Updates from Purchases: The inventory system only updates when purchases are made; making it unaware of lost, stolen or damaged goods; resulting in inaccurate information.

Shrink Identification and Investigation: When SMs (store managers) need to investigate unusual shrink, they tend to not know where to begin and how to target an approach to reduce losses.

Eyeballed Observations: Often, corrections to the inventory system are only made when associates recognize a severe lack of items on shelves over a 2–3 day period; leaving out-of-stocks unaddressed and enabling loss in potential revenue.

Process inefficiencies: Poor item-level visibility enables inventory management inefficiencies and theft

- Updating the inventory system with unit variance data based on eyeballed observations of employees is negligent of customer service and enables the loss of sales due to out-of-stocks.

- Monthly item audits are too infrequent to keep up with changes in demand, shelf stock and location of items; and causes delays in in-stock inventory updates and item replenishments onto shelves.

- Requiring SM’s to investigate unusual variance or shrink is unreasonably diverting resources from serving customers, and provides no clear path to success of the SM uncovering the inefficiency.

- Lack of a system to explicitly identify stolen items in inventory records leads to indeterminate sources of shrink and restricts accurate inventory counts from being updated within a reasonable time.

- Not expanding inventory systems to include the status of sale at an item-level makes purchase verification for product returns difficult for associates to perform in order to combat return fraud.

- Having no way to locate misplaced items within stores allows the loss of revenue, an impaired customer service experience (expect to find something, but don’t), and inaccurate inventory details.

Process inefficiency statistics: Walmart experiences prominent inefficiencies in inventory management

~ 5.5% in the estimated amount of total merchandise in storage that should be on the retail floor.

~ 65% of inventory accuracy rate, for prediction and management of stock levels in stores.

~ 1.46% is the estimated percentage of gross revenue lost to under and overstock of merchandise.

~ 15% is the estimated percentage of items left out-of-stock on shelves because associates didn’t know they needed to be replenished.

~ 0.33% in value of goods as a % of total revenue that is stolen and ~ 0.91% in value of goods as a % of total revenue that is returned fraudulently.

Attempted solutions: Solutions have been implemented to combat inventory issues, but don’t work well

- Automated reordering: Walmart’s inventory system predicts when and how much to reorder a certain item, to efficiently restock. Because this is based on inventory system data that is only 65% accurate, automated reordering often results in inventory distortion.

- Inventory forecasting: With various data points regarding demand and customer behavior, the inventory forecasting system recommends how much of a specific product to stock. Forecasting also depends on inventory system data and inherits the inefficiency from such.

- Bossa Nova Robotics: Walmart’s partnership enables a robot to go around the store scanning inventory on shelves. The robot, however, may impede on customers and would need to be implemented at a mass scale to offer consistent and reliable inventory data.

- myProductivity app: Empowering associates with data, the app gives access to inventory data, allowing employees to provide great customer service. Is a great associate enabler, but is only as reliable as the data its updated with; which is often inaccurate and delayed.

Recommendation: Utilize item-level RFID tagging and an in-store sensor network to drastically increase full-store product visibility

Overview: Utilize item-level RFID tagging and an in-store sensor network to drastically increase full-store product visibility.

- RFID tags at the item-level: 0.75 inches (size of a penny) round 96-bit passive ultrahigh-frequency RFID inlay, encoded with respective electronic product code, using 3M adhesive backs embedded to every single item at the point of manufacture.

- RFID sensor network: Ceiling or shelf mounted, 1200-sqft range RFID sensors throughout the store in a grid-like pattern for full coverage, in addition to exit gateway scanners.

- Inventory system integration: Real-time cross-update to inventory management system with data from RFID-based shelf stock and item location monitoring for more specific and up-to-date inventory insight (to prevent parallel data sets).

- Connected POS systems: Amalgamated POS systems allowing cross-check with the inventory system to enable product return verifications with its exit status (designating if the item is sold, not sold, etc).

Overview: Implementing item-level RFID tagging

RFID tags will allow individual items to be identified along with detailed product information from a distance of 15–20 feet, enabling accurate inventory checks, item locating and potentially identifying products customers purchase in real time from a distance for an autonomous store system.

Tags should ultra-high frequency 96-bit passive penny-sized sticker. The tag will contain the electronic product code (EPC) of the item for most precise usage, as compared to the incumbent barcode system conveying the universal product code (UPC). Passive tags are also the cheapest as they don’t contain a battery. The estimated cost of RFID tags is ~$0.15, per unit.

Impinj, NXP Semiconductors, and Alien Technologies are reputable and experienced retail RFID chip manufacturers often used by many retail chains. Contacts at these companies can be found later.

Overview: Installing full-store RFID sensor coverage

Installed RFID sensors will allow stores to identify the exact EPC of items from 15–20 feet away, automatically. This will remove the need for inventory audits. Real-time location tracking will also alert employees when items are misplaced, so they can be returned.

A network of ceiling- or shelf-mounted sensors placed throughout the store will be able to identify all products. Sensors can also identify the in-store location of RFID items through sensor triangulation, down to an accuracy of 1m. Sensors have coverage of ~1200 sqft; the average store would require 83 sensors to attain full-store coverage of retail floor.

Motorola and Impinj are the leading sensor provider and are used by numerous retailers, where the cost of the Speedway-Xarray RFID reader from Impinj is ~$4 000 and is used by numerous retailers.

Overview: Integrating with POS and inventory management systems

The real-time collected data regarding the stock levels of products and in-store location should be amalgamated with the inventory management system to keep most updated information on a widely-used and accessible database, without the confusion of a parallel dataset.

This allows consumers and associates to have accurate stock information, enables product return verification, and engage in analytics regarding demand patterns. Walmart can also provide smoother checkouts, as RFID sensors could potentially be embedded in carts or at checkouts stations.

This will require a time investment as numerous systems need to be modified to allow RFID-enabled purchases (substituting the scanning of a barcode).

Benefits: Automated item location and stock-level tracking are the greatest benefits

- Real-time tracking of stock-levels on shelves increases real-time inventory accuracy; enables automated audits; predicts efficient restocking; decreases markdowns; reduces stock-on-hand and improves customer experience through availability visibility.

- Cross-updated data with the inventory system enables more efficient return verification; increases transparency in shrink sources and stolen items; creates for a smoother checkout process; enables more detailed inventory and purchase data for accurate demand forecasting.

- Real-time item-location in stores can locate misplaced items store-wide and identify items in storage that should be on the retail floor, to avoid a loss of sale, as well as recognize products that could be being stolen, in real-time.

RFID integration can also make for more accurate inventory forecasting, to gain more efficient stocking predictions to reduce loss from over or under stocking items.

They can recognize items in the wrong locations in stores to return them to their correct shelf space in order to avoid the potential loss of sale. RFID implementation will be able to identify theft in real-time, giving better insight to develop anti-theft practices, and potentially catch shoplifters red-handed. It will also be able to verify items have been purchased when returned to prevent individuals from defrauding Walmart by ‘returning’ items they hadn’t bought.

Another advantage is that the system will be able to assess the number of products in storage rooms and on shelves in real-time and more efficiently restock to minimize out of stock items on shelves.

Store RFID usage can be used as item recognition from a distance for consumers in the event Walmart begins testing ‘Amazon Go’ like autonomous store system, and can act as an automated system to proactively manage inventory variance, and alert SMs appropriately.

Cost Analysis: Total annual cost of implementation is ~$55 mm

Assuming a 25% reduction in inventory distortion and theft & fraud expenses, Walmart is positioned to save upwards of ~ $180 mm. And subtracting the annual expenses of RFID tag and sensor implementation, at ~ $55 mm, Walmart can realize savings of up to ~ $125 mm from its ~$735 mm in its respective expenses, through full-store RFID tag and sensor implementation.

This is an effective ~ 0.49% increase in revenue for Walmart Canada.

At a dollar level, $1 in investment leads to a $2.27 in annual, recurring savings.

Impact: Case study analysis

Understanding the financial and operational impact Walmart Canada can experience, through studies done by GS1 and Northwestern University regarding RFID implementation in retail, of stores like Macy’s and smaller apparel stores like Adidas, Lululemon, MARC O’POLO and more.

RFID works for Macy’s and can work (even better) for Walmart too

“Macy’s plans to expand its use of RFID to track every item across its fleet of stores and fulfillment centers by the end of 2018, amd we are already halfway to this goal of tagging 100% of products.” — Bill Connell, SVP Store Operations, Macy’s

- A Radical inventory accuracy increase: Macy’s experienced an increase in inventory from ~ 67% to ~ 98%, with that number maintaining above 95%.

- A Reduction of stock on hand: Macy’s experienced a decrease of stock on hand in stores by 13%, and saved ~ $1.55 mm per store.

- A decrease in gross unit variance: Macy’s experienced a decrease in gross unit inventory variance from ~ 4.5% to ~ 2.6%, and remained consistent.

- An increase in the ability to sell merchandise: Macy’s experienced a 6.1% increase in the ability to locate and sell merchandise that is RFID-enabled.

- A decrease in missed inventory: Macy’s discovered 5.5% of store stock in storage, should’ve been on the retail floor, and could act accordingly.

Drastic improvements in inventory management at retailers like Zara and Adidas

- 15% reduction in shrinkage due to external shoplifting.

- 18% decrease in out-of-stocks due to delayed shelf replenishment.

- The read-rate error of RFID tags is at 0.003%, compared to 1.5% of barcodes, at a scale of 1 billion reads.

- 16% reduction in SKUs found out-of-stock.

- 1.5% increase in sales correlated to RFID integration.

This study includes results from implementation by Adidas; C&A; Decathlon; Lululemon; Jack Wills; John Lewis; MARC O’POLO; Marks & Spencer; River Island; Tesco and Zara.

These improvements are also directly recognizable if Walmart Canada implements item-level RFID.

Considering Walmart’s previous efforts: Changes in price and technology makes RFID feasible now more than ever

Situation in 2003

Up-front expenses: RFID tags cost close to $1 each, making it extremely expensive to implement.

Advanced technology: Lack of sustainable data structures and demand forecasting algorithms make the data generated unused

Supply chain infrastructure: Resistance from vendors due to inadequate infrastructure to apply RFID tags lead to Walmart killing the initiative.

Situation in 2018

Up-front expenses: Tags costs inexpensive at ~$0.15; sensors are of a moderate cost but high performance allowing Walmart to buy less, and still having net savings.

Advanced technology: With versatile databases and AI to supplement, the data collected from item-level integration proves very efficient and effective.

Supply chain infrastructure: With obvious benefits and cost savings, vendors realize it could be passed onto them if they implement RFID tagging at the point of manufacture where it’s cheaper than ever to do so.

Challenges: System integration and offenders removing tag are the biggest challenges

Difficult integration into inventory and POS systems: Connecting RFID data streams with the current POS system and dated inventory system will prove challenging given the modifications required.

Assuring RFID tags are not removed: Offenders will begin using new tactics to steal from Walmart, such as removing tags from devices in stores, to make them invisible — this is the largest downside to such implementation.

You’ve made it to the end! After reading (or breezing) over this recommendation, you may agree that RFID implementation can prove very beneficial to any retail environment by enhancing store-wide product visibility and control.

Note that specific details and data points were revoked from this recommendation, to prevent NDA infringement; there is more evidence this is a great idea.

A special shoutout to Navid Nathoo and Nadeem Nathoo at The Knowledge Society for providing the opportunity to work on such an exciting engagement!

A big thank you to Fareena Contractor at the Walmart Innovation Community for creating a chance for high school kids (like me!) to be able to tackle real-world problems and have access to data that can be used to come up with creative solutions. As a high school student, all problem-solving situations assigned to us are fictitious; my experience on engagement with Walmart Canada was thrilling as it gave me a taste of the real world, and in an industry that I discovered I’m super passionate about retail tech!

The chance to do research and develop a solution knowing that Walmart Canada will be actively considering our proposals makes it extremely valuable and the realness factor made me care about it more than anything else I was working on.

At the end of the day, I came to realize the behemoth that is Walmart; from the complexities of store operations, to control and decision regarding projects, I learned a tremendous amount, and have come to a firm conclusion that as a combination of its role in accomplishing its mission of bringing low prices to consumers and willingness to innovate in stores using exponential and emerging technologies,

Walmart will be very successful in a tech-first world and will be an extremely exciting company to watch as it keeps reinventing great customer experience!

I’m Swarit Dholakia, a 17-year-old machine learning developer, and tech fanatic! You can connect with me on LinkedIn, follow me on Medium, or reach out to me at dholakia.swarit@gmail.com.

If you liked this article, please do share it, and take a read at my article “When computers behave like humans” to learn about artificial intelligence and machine learning!